Powerful payments.

End-to-end security.

Accept payments easily, securely, and in a way that fits your business.¹

A single platform for your payment needs

POS payments

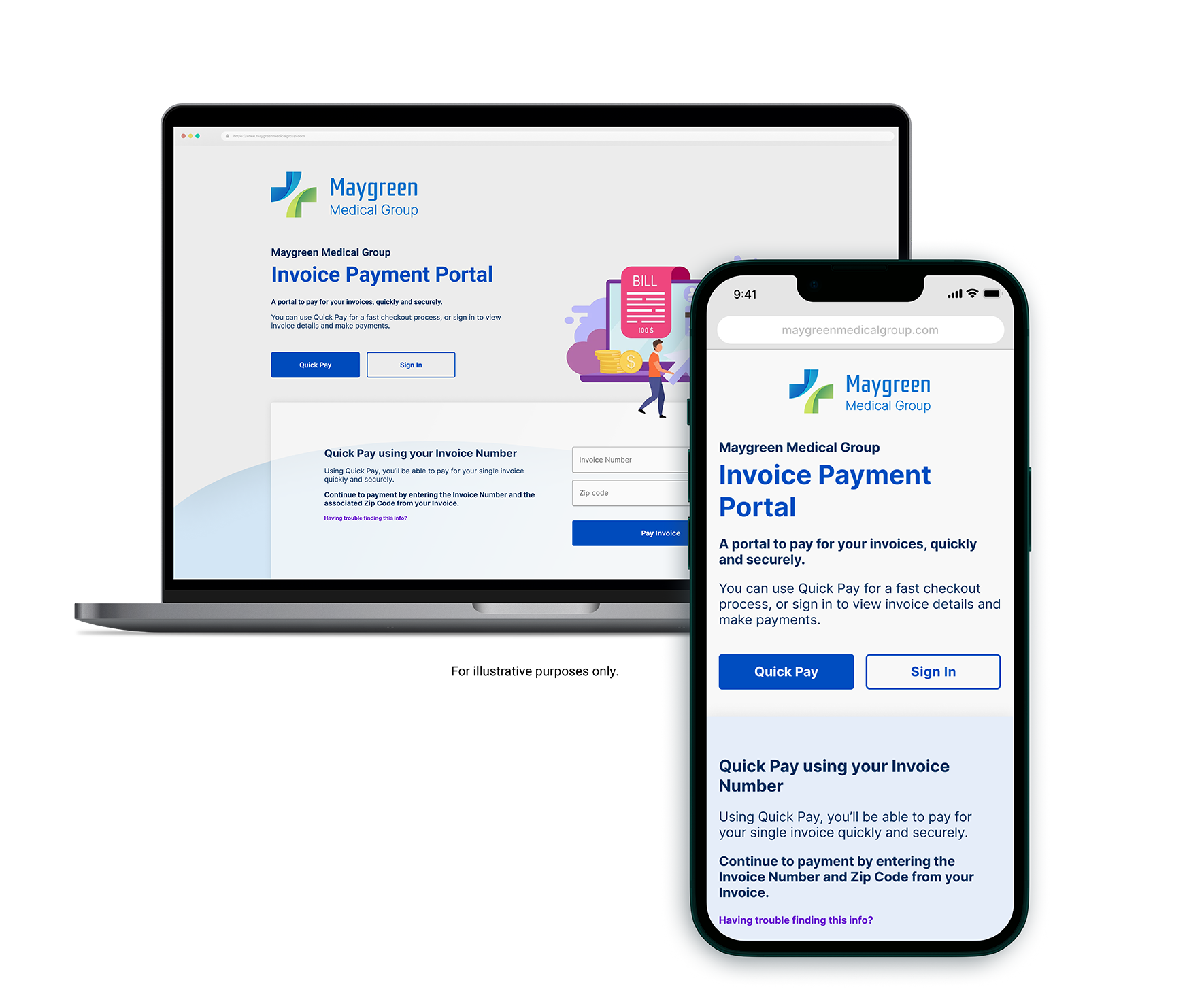

eCommerce payments

Device flexibility

Payment requests

We're more than a payment gateway.

Way more.

Tempus Technologies® solutions are PCI DSS compliant and fully customizable to fit your business' needs.¹

-

P2PE secure payment gateway

-

Smart and secure POS terminals

-

Robust payment-processing applications

-

Seamless mobile payments

-

Custom, hands-on solutioning to solve unique payment challenges

-

US-based support

-

Personalized training for your teams

Your success is our success

Personalized solutions

Tempus account managers can help walk you through a custom implementation.

Here when you need us

Our US-based support teams are available for whatever you need. No question is too small.

Hands-on training

Get personalized training and resources for everyone who needs it.

Security to put your mind at ease

Our secure P2PE payment gateway is PCI P2PE validated.¹ We use encryption and secure payment tokens for true end-to-end protection of each transaction.

Choose the way customers pay

Cards

ACH

eWallet

Paper checks

Specialized industry solutions

Retail

We have software and smart terminals to seamlessly integrate with your existing point-of-sale systems.

Healthcare and pharmacy care

Let us handle your payment needs with patient privacy front-and-center..jpg?width=2000&height=1333&name=brooke-cagle--uHVRvDr7pg-unsplash%20(1).jpg)

Education

Keep your students' and their families' financial information secure while supporting all your payment acceptance needs.¹

Insurance and financial services

Sensitive data is secure through our PCI DSS compliant payment gateway.¹Let's find your solution

Tempus prides itself in meeting your business' unique needs. Our custom solutions grow with your business, and US-based support means you'll have help when you need it.

Important legal disclosures and information

1. Payment Card Industry Data Security Standards (“PCI DSS”) are a mandatory set of security standards designed to help reduce the risk of fraud and theft of sensitive credit and debit card data. Tempus is a validated PCI Level 1 Service Provider.

Ingenico name or the Ingenico Partner badges are trademarks or registered trademarks of Ingenico Terminals SAS.